ESIC Online Payment 2025

Employees of the Employees' State Insurance Corporation (ESIC) can now pay their challan dues online. This separate business manages the employees' State protection, a program that gives Indian workers health and social security protection. Both employers and employees must fill out the ESIC Registration form in Challan. The company puts in 4.75 percent of the worker's pay, and the worker puts in 1.75 percent. Employees who make less than ₹ 137 a day don't have to pay into ESIC. People with access to net banking can pay their bills online, saving time and effort because they don't have to go to government buildings. Every month on the 15th, eligible people for ESIC must pay their bills online.The objective of ESIC Online Payment

The main goal of ESIC's online payment method is to let people pay their challans without going to a government office. This project saves time and effort while making the system more open. People who want to pay for things online must be able to use net banking. Contributions to the Employee's State Insurance Corporation must be made by employees as well as employers. These contributions can now be easily made from home.Features & Benefits

1) People who are part of the Employee State Insurance Corporation can now pay their challans online.

2) The State Insurance Corporation is in charge of the employee State Insurance program for Indian workers. This is a health insurance and social security program.

3) Employers pay 4.75 percent of the wages that employees are due, and employees pay 1.7 percent.

4) If an employee's daily pay is less than ₹ 137, they don't have to pay into ESIC.

5) People with an SBI account and access to net banking can pay their ESIC bills online.

6) Online transfers make things easier, save time and effort, and clarify the system.

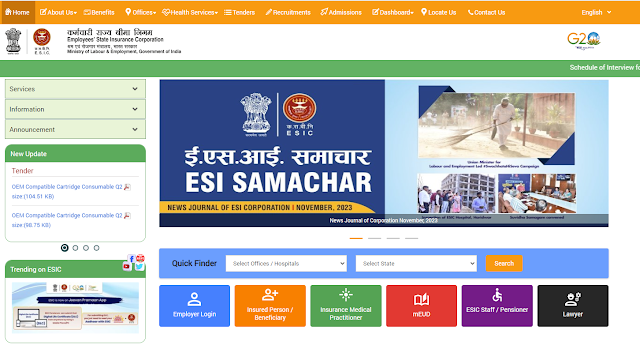

Steps to Register on the ESIC Portal

1) Go to the ESIC page first, which is https://www.esic.gov.in/.

2) The website's home page will appear on the screen.

3) Click on "Employer Login."

4) The login page will appear on the screen.

5) Select "Sign up" from the menu.

6) The sign-up form will appear on the screen.

7) Now, fill in all the necessary information.

8) click the "Submit" button to finish the sign-up process.

Steps to Login on the ESIC Portal

1) Go to the ESIC website: https://www.esic.gov.in/.

2) The website's home page will appear on the screen.

3) Click on the link that says "Employer Login."

4) The page to log in will show up on the screen.

5) Enter your name, password, and the security code now.

6) click the "Login" button to access your account.

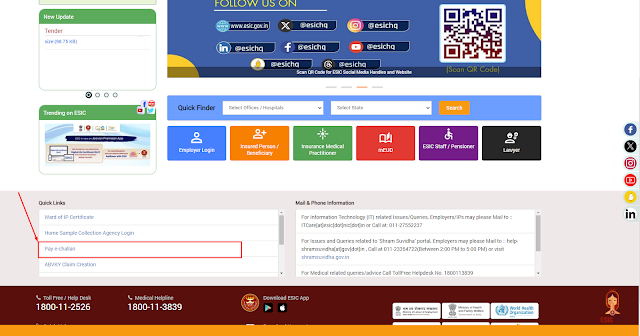

Steps to Generate an Online Challan

1) Visit the ESIC Official Website: https://www.esic.gov.in/.

2) The website's home page will appear on the screen.

3) Click the "Pay e-challan" under the quick links section.

2) The website's home page will appear on the screen.

3) Click the "Pay e-challan" under the quick links section.

4) The screen will show a new page.

5) Enter Employee Code and Captcha and click the "Search" button.

6) Enter the amount that needs to be paid and click the record that the payment should be made.

7) Click on the Online button now.

8) After that, click the "Submit" button.

9) The submission of the request will result in a notification.

10) Finally, click the OK button.