Individuals in this situation can surrender their PAN cards by sending a letter to the Income Tax Assessing Officer within the office's authority.

The PAN card can be returned to the relevant tax authority when cancelled.

For various reasons, some situations call for surrendering a PAN card by the cardholder or the entity that owns the card. Follow the steps below to Surrender your PAN card, depending on your situation.

Also Read: Apply Pan Card for Minor

Due to an administrative error or if the person or entity applied more than once and obtained a PAN card each time, numerous PAN cards may have been issued to the same person or entity. The duplicate PAN cards must be returned because it is against the law to possess more than one PAN card at once. Both online and offline methods are available for surrendering a duplicate PAN card.

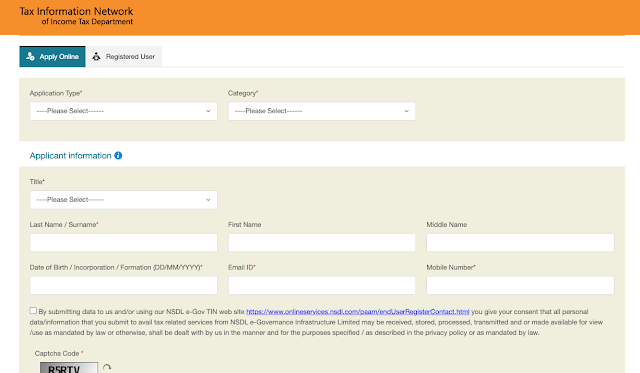

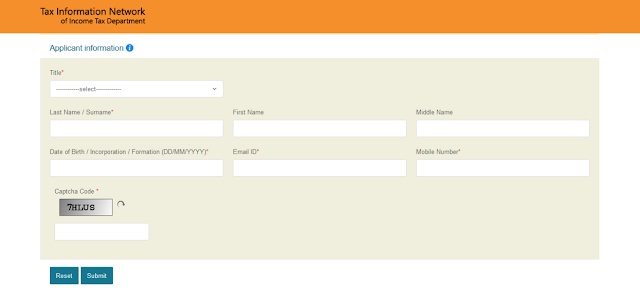

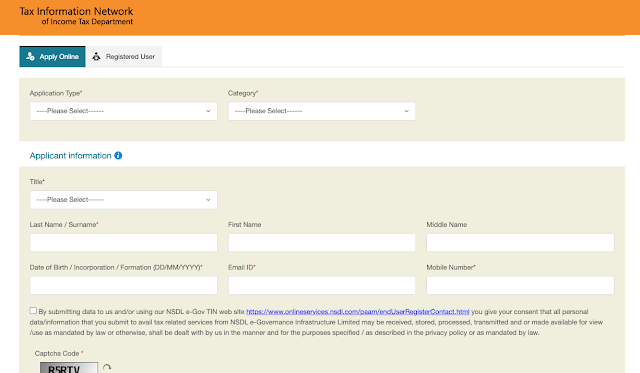

1) Go to the Income Tax Department website (https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html).

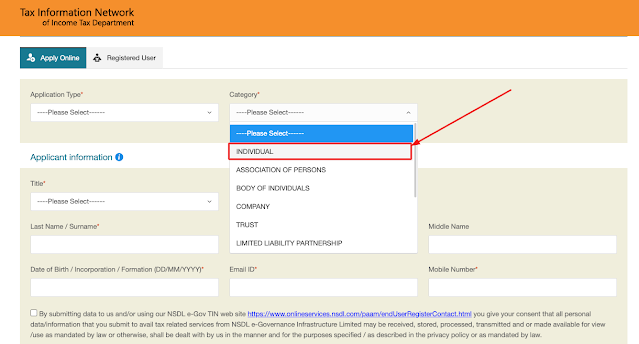

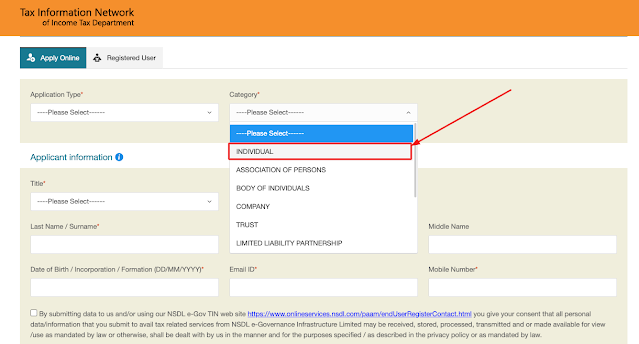

2) Select Individual from the Category drop-down menu.

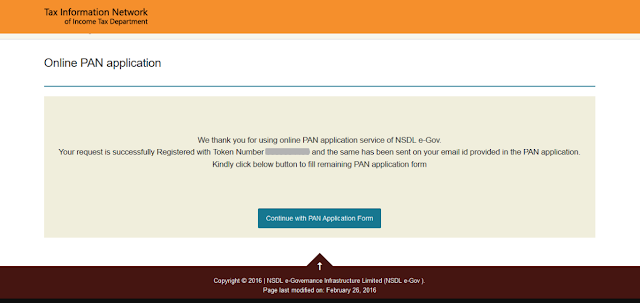

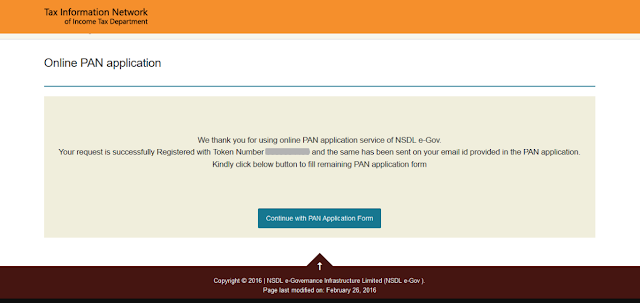

4) You should note down the token number for future use. Continue by clicking the "Continue with PAN Application Form" button at the page's bottom.

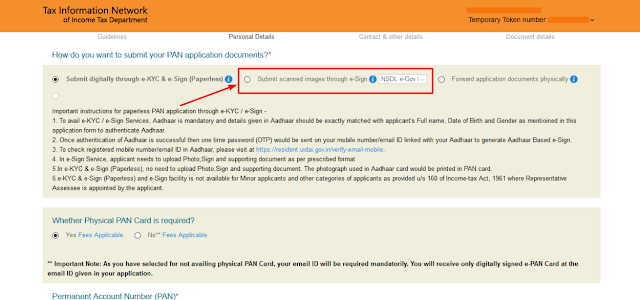

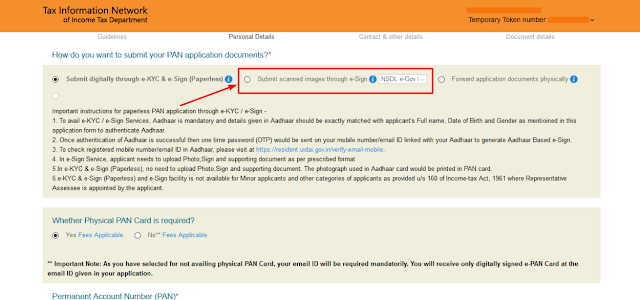

5) The user would be redirected to another web page. Click the Submit scanned images by e-Sign option at the page's top.

6) The user must then fill out the Form with personal information, such as their phone number. On the next page, the user must list the extra PAN cards and the information they want to give up. When you're done, click the Next button. On the next page, choose the valid Proof of Identity and fill in your address and date of birth.

7) The user would then have to upload scanned images of their photos, signatures, and other necessary documents. To ask for the PAN to be returned, the person must sign the acknowledgement receipt or get approval from someone authorised to sign. In the case of a Company giving up its PAN, for example, a Director is a person who is allowed to sign. For a Partnership Firm/LLP, on the other hand, a person who is allowed to sign would be a partner.

8) Users can review their application form Once they successfully send in their information. The user must check the information and make necessary changes before paying.

13) The user has to send a printed copy of the acknowledgement and two photos of themselves to the National Securities Depository Limited eGovernment. Before the receipt is sent, the envelope has to be labelled with "Application for PAN Cancellation" and the "Acknowledgment Number."

Surrender Duplicate PAN Card:

How to Surrender a Duplicate PAN Card - Online

2) Select Individual from the Category drop-down menu.

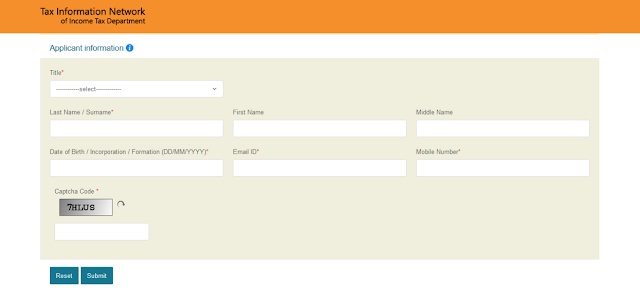

3) Fill out the Form with the necessary information and click the "Submit" button. After successfully submitting the Form, the request will be registered, and a token number will be created. This token number would be delivered to the email address specified in the application.

4) You should note down the token number for future use. Continue by clicking the "Continue with PAN Application Form" button at the page's bottom.

6) The user must then fill out the Form with personal information, such as their phone number. On the next page, the user must list the extra PAN cards and the information they want to give up. When you're done, click the Next button. On the next page, choose the valid Proof of Identity and fill in your address and date of birth.

7) The user would then have to upload scanned images of their photos, signatures, and other necessary documents. To ask for the PAN to be returned, the person must sign the acknowledgement receipt or get approval from someone authorised to sign. In the case of a Company giving up its PAN, for example, a Director is a person who is allowed to sign. For a Partnership Firm/LLP, on the other hand, a person who is allowed to sign would be a partner.

9) The user must pay with a debit card, credit card, Internet banking or Demand Draft. Once the payment has been accepted, the user can download a soft copy of the payment acknowledgement. This payment receipt needs to be kept and printed out for future use. It also serves as proof that the payment was made.

14) Send the signed acknowledgement and the Demand Draft, if that is how you choose to pay, to the address listed below.

When a PAN cardholder dies, his or her family must send a letter to the Income Tax Officer in charge of that area. The letter must include the death certificate of the PAN card holder and the reason for giving up the card, which in this case is that the cardholder has died. The letter should include essential details like the person's name, PAN card number, date of birth, etc. When a Non-Indian Resident or a Foreign National dies, they must also give up their PAN card like an Indian Resident dies.

If you want to cancel your duplicate PAN cards online, follow the steps below. You can give up your PAN card online by going to the National Securities Depository Limited Tax Information Network (TIN) portal and filling out form 49A.

When a Company, Firm, or Partnership is shut down or dissolved, the PAN issued in the entity's name must be returned to the appropriate people.

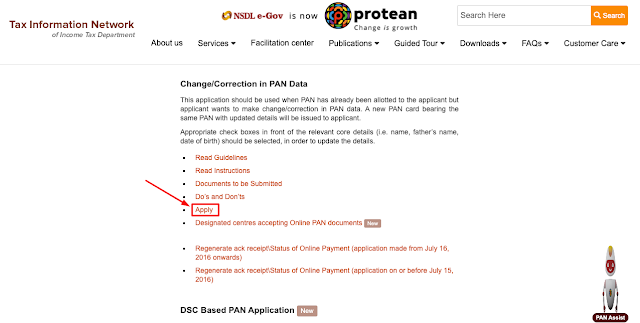

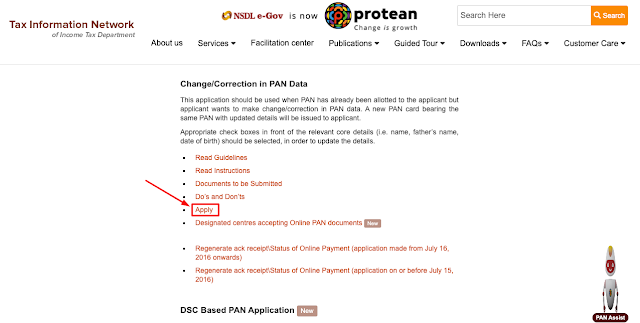

2) Click on the "Services" tab and choose "PAN" from the list. Click the "Apply" button under Change/Correction in PAN data.

3) Click on the type of application. Click the option from the drop-down menu on the Changes or Corrections to Existing PAN Data/Reprint of PAN Card (No Changes to Existing PAN Data).

7) The user will get a notification once the request has been handled, letting them know.

NSDL e-Gov at 'Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune – 411 016

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune – 411 016

Surrender PAN Card due to Death of Individual Holder.

Surrender of Firm / Partnership / Company PAN Card

When a Company, Firm, or Partnership is shut down or dissolved, the PAN issued in the entity's name must be returned to the appropriate people.

1) Visit the NSDL Official Website : ( https://www.protean-tinpan.com/index.html)

2) Click on the "Services" tab and choose "PAN" from the list. Click the "Apply" button under Change/Correction in PAN data.

3) Click on the type of application. Click the option from the drop-down menu on the Changes or Corrections to Existing PAN Data/Reprint of PAN Card (No Changes to Existing PAN Data).

4) Select Company, Firm or Partnership from the Category drop-down menu and complete the Form online.

5) Enter the PAN that needs to be cancelled in Form 49A's Item 11.

6) Print out the acknowledgement before sending the completed Form. The user must send the needed documents to the NSDL Office Address on the Form.

6) Print out the acknowledgement before sending the completed Form. The user must send the needed documents to the NSDL Office Address on the Form.

7) The user will get a notification once the request has been handled, letting them know.