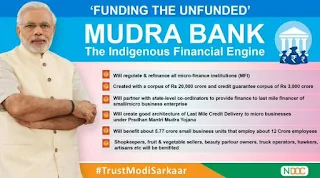

Mudra Bank Loan Yojana (PMMY) Details: Mudra Bank Loan Yojana (PMMY) Scheme is launched by the Indian government. This scheme was helpful for Business People. Many persons have a lack of knowledge to start a business but due to financial problems, they are unable to start the business. By mudra Bank Loan Yojana (PMMY) scheme the government will give the loan for the small business and large business.

This scheme was helpful for start-ups and other small business who are financially weak. We provide the complete information on this "Mudra Bank Loan Yojana". How to apply for Mudra Bank Loan Yojana, where to apply for Mudra Bank Loan Yojana, and other information.

Knowing about Mudra Bank Loan Yojana was very important if you are interested. Many factors included in this "Mudra Bank Loan Scheme" like interest rate, guidelines, Types of loans and other details.

1) Shishu Loan Details: Under this scheme, persons are eligible for a 50,000rs loan from the bank. the small business you are looking for the loan. Intrest rate for this Shishu loan category is 10 to 12%.

2) Kishor Loan Details: Under this scheme, Persons are eligible for 5 lakhs rupees loan from the bank. This loan is applicable for who have already started the small business. Intrest rate for this Kishor Loan category is 14 to 17%.

3)Tarun Loan Details: Under this scheme, Persons are eligible for 10 lakhs loan from the bank. Who has started the small business and persons should meet the benchmarks. Once they can be done they will be eligible for 10 lakhs.

1)Passport size photograph

2)Self-attested Address Proof

3)Self-attested Identify Proof

4)Your company and address proof

5)In case if you are purchased the machine. Just submit the machine name and machine price and also seller name.

6)Proof of category like (sc, st, bc, ebc, oc etc.)

Note:

1)No Processing Fee

2)No Collateral

3)Repayment period of loan extended up to 5years

4)Applicant should not be a defaulter of any bank / financial institution.

Micro Units Development and Refinance Agency (MUDRA) has finalized the eligibility norms for the partner lending institutions for the purpose of availing refinance/ finance for onlending to micro units in manufacturing, trading and service sector in rural and urban areas. The eligible institutions, as indicated below, may approach MUDRA corporate office at First Floor, MSME Development Centre, C-11, G Block, Bandra Kurla Complex, Bandra East, Mumbai – 400 051 or the nodal officers placed across the country.

a. Been in lending to Own Account Enterprises, i.e. micro units with loan size up to Rs.10 lakh for at least 3 years and/or the promoters/management having experience of at least 10 years in this area.

b. Having minimum out reach of 3000 existing borrowers for MFIs.

c. Having suitable systems, processes, and procedures such as internal accounting, risk management, internal audit, MIS, cash management, etc.

d. Meeting the minimum CRAR and other norms stipulated by RBI for MFIs registered as NBFC-MFIs and comply all the prevailing RBI guidelines. For all categories of NBFCs, registration with RBI will be mandatory.

e. Should be a member of a Credit Bureau.

f. Rating requirement:

a. MFIs (including NBFC-MFIs) – minimum Capacity Assessment Rating of mfr5 by CRISIL or its equivalent.

b. NBFCs – minimum external rating of BB- for small NBFCs having total portfolio below Rs. 500 crore and BBB+ for NBFCs having a portfolio of Rs. 500 crore or more. For small NBFCs not having an external credit rating, they should possess satisfactory borrowing arrangements with any Scheduled Commercial Bank for a minimum of 2 years.

g. Recovery performance: For MFIs: Portfolio at Risk (i.e. overdue more than 30 days) within 5%. For others - Net NPA not higher than 3%.

h. For all MFIs, it will be desirable to have undergone Code of Conduct Assessment (COCA) with a minimum score of 60 or equivalent.

COMMON PARAMETERS

1. The assistance will be based on internal credit appraisal process by MUDRA / SIDBI.

2. The assistance shall be priced based on risk assessment, geographical distribution, social parameters, etc.

3. The Board of MUDRA shall fix prudential ceilings for lending to various categories of borrowers as also limits for individual borrower/borrower group in line with RBI instructions on the subject.

4. The detailed terms of assistance shall be laid down in the loan agreement to be executed with the individual intermediary.

Note :

1) These institutions have to submit their latest financial status/position and submit a loan application for availing of financial assistance from MUDRA Ltd.

2) The MFIs although registered in a particular center or a state can also operate in other centers and states, according to their bye laws. Accordingly, these institutions cover most of the States.

This scheme was helpful for start-ups and other small business who are financially weak. We provide the complete information on this "Mudra Bank Loan Yojana". How to apply for Mudra Bank Loan Yojana, where to apply for Mudra Bank Loan Yojana, and other information.

Knowing about Mudra Bank Loan Yojana was very important if you are interested. Many factors included in this "Mudra Bank Loan Scheme" like interest rate, guidelines, Types of loans and other details.

Mudra Bank Loan Yojana Details

There are a lot of small business and start ups, Entrepreneurs in India. These all sectors are called small micro units. Some micro units company don't have financial support to grow the business much better than currently.

Full form of mudra is " MICRO UNITS DEVELOPMENT AND REFINANCE AGENCY LTD"

Overview of Mudra Loan:

Here is mudra loan you can apply in the bank for 3 kinds of mudra loans. Every bank offers loans for small and large business. Below we have given various kinds of loans (Shishu Loan, Kishor Loan, Tarun Loan) for small and large business.

2) Kishor Loan Details: Under this scheme, Persons are eligible for 5 lakhs rupees loan from the bank. This loan is applicable for who have already started the small business. Intrest rate for this Kishor Loan category is 14 to 17%.

3)Tarun Loan Details: Under this scheme, Persons are eligible for 10 lakhs loan from the bank. Who has started the small business and persons should meet the benchmarks. Once they can be done they will be eligible for 10 lakhs.

Required Documents for Mudra Bank Loan Yojana

2)Self-attested Address Proof

3)Self-attested Identify Proof

4)Your company and address proof

5)In case if you are purchased the machine. Just submit the machine name and machine price and also seller name.

6)Proof of category like (sc, st, bc, ebc, oc etc.)

Note:

1)No Processing Fee

2)No Collateral

3)Repayment period of loan extended up to 5years

4)Applicant should not be a defaulter of any bank / financial institution.

Eligibility Criteria For Mudra Refinance/Loan

Micro Units Development and Refinance Agency (MUDRA) has finalized the eligibility norms for the partner lending institutions for the purpose of availing refinance/ finance for onlending to micro units in manufacturing, trading and service sector in rural and urban areas. The eligible institutions, as indicated below, may approach MUDRA corporate office at First Floor, MSME Development Centre, C-11, G Block, Bandra Kurla Complex, Bandra East, Mumbai – 400 051 or the nodal officers placed across the country.

Scheduled Commercial Banks

All scheduled commercial Banks in public and private sector with 3 years of continuous profit track record, net NPAs not exceeding 3%, minimum net worth of Rs.100 cr. and not less than 9% CRAR.Regional Rural banks

All restructured RRBs having net NPA within 3% ( relaxable in deserving cases), having profitable operations and not carrying any accumulated losses and CRAR >9%.MFI / SMALL BUSINESS FINANCE COMPANIES/NBFC

a. Been in lending to Own Account Enterprises, i.e. micro units with loan size up to Rs.10 lakh for at least 3 years and/or the promoters/management having experience of at least 10 years in this area.

b. Having minimum out reach of 3000 existing borrowers for MFIs.

c. Having suitable systems, processes, and procedures such as internal accounting, risk management, internal audit, MIS, cash management, etc.

d. Meeting the minimum CRAR and other norms stipulated by RBI for MFIs registered as NBFC-MFIs and comply all the prevailing RBI guidelines. For all categories of NBFCs, registration with RBI will be mandatory.

e. Should be a member of a Credit Bureau.

f. Rating requirement:

a. MFIs (including NBFC-MFIs) – minimum Capacity Assessment Rating of mfr5 by CRISIL or its equivalent.

b. NBFCs – minimum external rating of BB- for small NBFCs having total portfolio below Rs. 500 crore and BBB+ for NBFCs having a portfolio of Rs. 500 crore or more. For small NBFCs not having an external credit rating, they should possess satisfactory borrowing arrangements with any Scheduled Commercial Bank for a minimum of 2 years.

g. Recovery performance: For MFIs: Portfolio at Risk (i.e. overdue more than 30 days) within 5%. For others - Net NPA not higher than 3%.

h. For all MFIs, it will be desirable to have undergone Code of Conduct Assessment (COCA) with a minimum score of 60 or equivalent.

COMMON PARAMETERS

1. The assistance will be based on internal credit appraisal process by MUDRA / SIDBI.

2. The assistance shall be priced based on risk assessment, geographical distribution, social parameters, etc.

3. The Board of MUDRA shall fix prudential ceilings for lending to various categories of borrowers as also limits for individual borrower/borrower group in line with RBI instructions on the subject.

4. The detailed terms of assistance shall be laid down in the loan agreement to be executed with the individual intermediary.

List of MFIs shortlisted (Tentative)

| S.No. | Bank Name Place in which Registered | Office is situated |

|---|---|---|

| 1 | S V Creditline Pvt. Ltd. | Gurgaon. |

| 2 | Margdarshak Financial Services Ltd. | Lucknow. |

| 3 | Madura Micro Finance Ltd. | Chennai. |

| 4 | ESAF Micro Finance & Investments P. Ltd. | Thrissur, Kerala. |

| 5 | Fusion Micro Finance P. Ltd. | New Delhi. |

| 6 | Ujjivan Financial Services P. Ltd. | Bangalore. |

| 7 | Future Financial Services Ltd. | Chitoor, Andhra Pradesh. |

| 8 | SKS Microfinance Ltd. | Hyderabad. |

| 9 | Utkarsh Micro Finance P. Ltd. | Varanasi |

| 10 | Equitas Micro Finance Pvt. Ltd. | Chennai. |

| 11 | Sonata Finance Pvt. Ltd. | Allahabad. |

| 12 | Saija Finance Private Ltd. | Patna. |

| 13 | Arth Micro Finance Pvt. Ltd. Jaipur, | Rajasthan. |

| 14 | Shikhar Microfinance Pvt. Ltd. Dwaraka, | New Delhi. |

| 15 | Navachetana Microfin Services Pvt. Ltd. | Haveri, Karnataka. |

| 16 | Samasta Microfinance Ltd. | Bangalore. |

| 17 | Satin Credit Care Network Ltd. | Delhi. |

| 18 | Sahyog Microfinance Ltd. | Bhopal. |

| 19 | Arohan Financial Services P. Ltd. | Kolkata. |

| 20 | Cashpor Micro Credit | Varanasi |

| 21 | Digamber Capfin Ltd. | Jaipur |

| 22 | Bhartiya Micro Credit | Lucknow. |

| 23 | Sakhi Samudaya Kosh | Solapur. |

| 24 | Midland Microfin Ltd. | Jalandar. |

| 25 | RGVN (North East) Microfinance Ltd. | Guwahati. |

Note :

1) These institutions have to submit their latest financial status/position and submit a loan application for availing of financial assistance from MUDRA Ltd.

2) The MFIs although registered in a particular center or a state can also operate in other centers and states, according to their bye laws. Accordingly, these institutions cover most of the States.

Mudra Loan Application Form: Click Here

Official Explaining Process: Click Here

Official Eligible Criteria: Click Here